Import

Importing goes far beyond bringing products from abroad; it means aligning logistical, tax, and operational processes with strategy and security. SILCORTRADING operates with a door-to-door model, handling the entire operation, from shipment at origin to final delivery in Brazil, with excellence at every stage.

Our import model includes:

Quotation and strategic contracting of international freight;

Quotation and strategic contracting of international freight; Transport insurance management and logistical risk mitigation;

Transport insurance management and logistical risk mitigation; Complete customs clearance;

Complete customs clearance; Tax analysis and issuance of outbound invoices;

Tax analysis and issuance of outbound invoices; Real-time operational monitoring with continuous follow-ups.

Real-time operational monitoring with continuous follow-ups.

Export

Expanding borders requires more than intention — it requires strategy. With the expertise of SILCORTRADING, your export operations gain strength, compliance, and efficiency at every stage. Reach new markets with safety and competitiveness.

Our complete advisory includes:

-

Commercial planning and international pricing strategy;

Commercial planning and international pricing strategy;

-

Cost simulation and tax analysis;

Cost simulation and tax analysis;

-

Issuance of documents required by Brazilian and foreign authorities;

Issuance of documents required by Brazilian and foreign authorities;

-

Registration and monitoring of operations in SISCOMEX;

Registration and monitoring of operations in SISCOMEX;

-

Verification of trade barriers, sanitary requirements, and legal conditions of the destination country;

Verification of trade barriers, sanitary requirements, and legal conditions of the destination country;

-

Logistical management and cargo dispatch until shipment.

Logistical management and cargo dispatch until shipment.

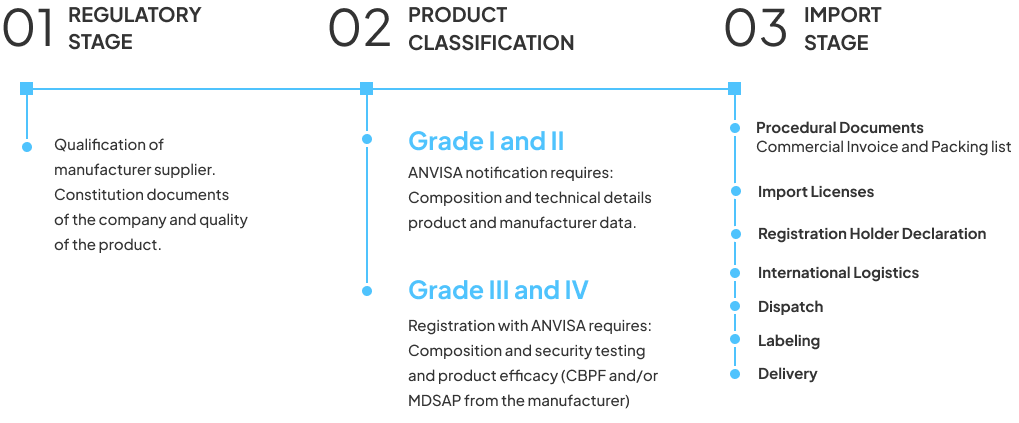

Healthcare Products Import

SILCORTRADING operates with precision, agility, and full compliance to import medical, hospital, and laboratory products. A specialized solution focused on traceability, legal security, and strict control at every stage.

Our process includes:

- Technical product analysis and manufacturer evaluation according to regulatory requirements;

- Health risk classification and management of registration processes with ANVISA;

- Import license requests and regulatory notification management;

- Labeling adjustments, preparation of technical documentation, and customs release;

- Integrated door-to-door logistics with full traceability until final delivery.

Hospital Doctor

Distribution with nationwide presence

and strong market performance.

We operate as the official and exclusive distributor of imported products in Brazil,

providing a solid structure and broad national coverage to serve different regions

with efficiency and reliability.

From storage to final delivery.

Storage in key logistics hubs

Inventory management with real-time monitoring

Integration with marketplaces and certified carriers

Technical and commercial support for product positioning

Nationwide coverage with end-to-end traceability

Logistics Advisory

Efficient logistics transforms operational challenges into competitive advantages. SILCORTRADING offers customized and integrated logistics solutions, combining strategy, traceability, and agility across land, sea, and air transport — always focused on cost reduction and meeting deadlines.

We offer:

- Customized logistics planning adapted to the specific characteristics of each type of cargo;

- Strategic presence in Santa Catarina: Itajaí, Navegantes, Itapoá, Imbituba, São Francisco do Sul, and Florianópolis;

- Established partnerships with high-performance logistics operators and carriers;

- Efficient integration between sea, air, and land transport modes;

- Real-time monitoring through advanced tracking systems;

- Optimization of costs and delivery times.

Luxury Vehicles

Importing luxury cars represents a high-value opportunity in the Brazilian premium market. For this, the following is required:

- Direct import for the final client (individual) or company with an active CNPJ authorized in Radar/Siscomex;

- Vehicle compliant with IBAMA and INMETRO standards;

- Import License (LI) and technical documentation;

- Payment of taxes (II, IPI, PIS/COFINS, ICMS);

- Customs clearance and registration with DETRAN.

Despite the costs, the target audience values exclusivity and is willing to pay for differentiation. An excellent niche for resellers and automotive boutiques.

Expanding internationally requires more than identifying products or manufacturers — it demands supplier analysis, regulatory compliance, and an efficient supply chain. SILCORTRADING offers a strategic international sourcing service, acting as an extension of your company abroad.

Solutions we create for your business:

Development and qualification of suppliers and products;

Development and qualification of suppliers and products; Local teams in China, the USA, and other strategic markets;

Local teams in China, the USA, and other strategic markets; Direct negotiation with suppliers, including technical and commercial analysis;

Direct negotiation with suppliers, including technical and commercial analysis; On-site inspection, quality control, and shipment verification;

On-site inspection, quality control, and shipment verification; Cargo consolidation for logistics efficiency and cost reduction;

Cargo consolidation for logistics efficiency and cost reduction; Document management focused on compliance with Brazilian requirements.

Document management focused on compliance with Brazilian requirements.

GLOBAL PRESENCE

SILCOR has a solid international structure, with teams strategically located to serve the main development and manufacturing hubs in the world.

Our team in China consists of Brazilian and Chinese professionals, distributed across the regions of Shanghai, Zhejiang, and Shenzhen.

In the United States, our structure with a Brazilian team further expands SILCOR’s global presence.

This integrated international presence allows us to offer complete solutions, from product development to the creation of fully finished solutions.

Import

Tax Benefit – TTD 409 (Santa Catarina)

The Differentiated Tax Treatment (TTD 409), granted by the Santa Catarina State Department of Finance (SEF-SC), is one of the best tax incentives for importers in the country.

This regime allows the effective ICMS tax burden to be reduced through presumed credit, ensuring better financial performance, greater competitiveness, and operational security.

The operation is conducted in full compliance with all legal requirements of SEF-SC and the Normative Instructions of the Brazilian Federal Revenue Service.

Operation Models

Legal Basis: RFB Normative Instruction No. 1,861/2018

Legal Basis: RFB Normative Instruction No. 1,861/2018

Description: SILCOR Trading imports goods in its own name,

under a contract signed with the ordering client, who acquires ownership

of the goods after customs clearance. This model is recommended for companies

that do not have their own import structure or wish to test products and suppliers

with safety and agility.

Description: SILCOR Trading imports goods in its own name,

under a contract signed with the ordering client, who acquires ownership

of the goods after customs clearance. This model is recommended for companies

that do not have their own import structure or wish to test products and suppliers

with safety and agility.

Invoice: The outbound transaction is issued as a Sales Invoice,

including all applicable taxes, in accordance with current legislation.

Invoice: The outbound transaction is issued as a Sales Invoice,

including all applicable taxes, in accordance with current legislation.

Important: Imported goods cannot be sold to third parties

other than the contracted ordering client.

Important: Imported goods cannot be sold to third parties

other than the contracted ordering client.

Import on Behalf of and by Order of Third Parties

Legal Basis: RFB Normative Instruction No. 1,861/2018

Legal Basis: RFB Normative Instruction No. 1,861/2018

Description: In this model, SILCOR Trading acts as an import

service provider, carrying out the entire operation in the name and on behalf

of a third party (the purchaser), who owns the goods from the beginning of

the import process. Ideal for companies with an active CNPJ and their own

fiscal structure.

Description: In this model, SILCOR Trading acts as an import

service provider, carrying out the entire operation in the name and on behalf

of a third party (the purchaser), who owns the goods from the beginning of

the import process. Ideal for companies with an active CNPJ and their own

fiscal structure.

Invoice: Delivery is made through a Remittance Invoice,

without highlighting taxes on the product.

Invoice: Delivery is made through a Remittance Invoice,

without highlighting taxes on the product.

Additional Requirement: The purchaser must have an establishment

registered in the State of Santa Catarina to benefit from TTD 409.

Additional Requirement: The purchaser must have an establishment

registered in the State of Santa Catarina to benefit from TTD 409.

Advantages:

-

Significant reduction in the total tax burden

Significant reduction in the total tax burden

-

Operation maintained under the purchaser’s CNPJ

Operation maintained under the purchaser’s CNPJ

-

Greater fiscal control and traceability of the operation

Greater fiscal control and traceability of the operation

Why operate through Santa Catarina

Companies headquartered in São Paulo, Rio de Janeiro, Paraná, and other states have found in Santa Catarina a strategic and cost-effective alternative for their import operations.

Through the structure of SILCORTRADING, it is possible to import with a lower tax burden without compromising compliance, while ensuring delivery anywhere across the national territory.

OPERATIONAL

DISTRIBUTION

SILCORTrading offers complete Operational Distribution solutions for international companies looking to enter and establish themselves in the Brazilian market.

Our role is to manage the entire marketing logistics structure in Brazil, allowing the exporting partner to focus on their commercial and strategic operations.

We deliver efficiency, legal compliance, and operational security, ensuring that products correctly reach end customers throughout the country.

We manage the entire import and operational logistics structure in Brazil so that the exporting partner/manufacturer can maintain focus and responsibility over the commercial structuring in Brazil, including hiring commercial teams, planning and executing commercial actions, as well as defining strategic guidelines for marketing and brand positioning.

Import

Feasibility analysis and fiscal classification (NCM/HS Code)

Feasibility analysis and fiscal classification (NCM/HS Code) Complete customs clearance process

Complete customs clearance process Quotation and negotiation of international logistics

Quotation and negotiation of international logistics Foreign exchange transfers and document corrections

Foreign exchange transfers and document corrections

Logistics

Transportation from port to warehouse

Transportation from port to warehouse Controlled storage according to product demand

Controlled storage according to product demand Sorting and labeling when necessary

Sorting and labeling when necessary Specialized packaging

Specialized packaging Post-sale shipping logistics

Post-sale shipping logistics

Financial

Accounts payable and receivable

Accounts payable and receivable Cash flow control

Cash flow control Collection management

Collection management

Administration and Accounting

Invoice control

Invoice control Tax calculation and submission of reports to the Federal Revenue

Tax calculation and submission of reports to the Federal Revenue Personnel management and accounting statements

Personnel management and accounting statements Financial and managerial reports

Financial and managerial reports

Regulatory and Compliance

Product registration with competent authorities

Product registration with competent authorities Quality system management

Quality system management Review and approval of technical documents

Review and approval of technical documents Complete reports for tracking and compliance

Complete reports for tracking and compliance

SANTA CATARINA:

SANTA CATARINA:

The Best State to Expand Your Operations in Brazil

Santa Catarina has established itself as one of the most competitive states in Brazil, recognized for its strategic logistics infrastructure, business-friendly environment, and legal certainty. The state has become a benchmark for national and international companies seeking safe growth, operational efficiency, and competitive advantage.

Santa Catarina offers strong tax incentive programs, allowing importing, exporting, and industrial companies to reduce costs and increase competitiveness.

Differentiated Tax Treatment (TTD):

Tax incentive for companies engaged in import, export, or industrial operations.

Tax incentive for companies engaged in import, export, or industrial operations. Reduction of the ICMS tax calculation base in specific operations.

Reduction of the ICMS tax calculation base in specific operations. ICMS tax deferral on imports and production chains.

ICMS tax deferral on imports and production chains.

CDE-SC (Strategic Distribution Centers):

Benefit for companies with annual volume above R$ 15 million CIF.

Benefit for companies with annual volume above R$ 15 million CIF. Enables tax and logistics optimization, making the state highly attractive for large-scale operations.

Enables tax and logistics optimization, making the state highly attractive for large-scale operations.

Tax Substitution (ST):

Few interstate agreements, ensuring greater tax predictability and lower cash flow impact.

Few interstate agreements, ensuring greater tax predictability and lower cash flow impact.

Ports:

-

Itajaí, Navegantes, São Francisco do Sul, Imbituba, and Itapoá — some of the most efficient in Brazil.

Itajaí, Navegantes, São Francisco do Sul, Imbituba, and Itapoá — some of the most efficient in Brazil.

-

High productivity in container handling and capacity for general cargo, bulk solids, liquids, and refrigerated goods.

High productivity in container handling and capacity for general cargo, bulk solids, liquids, and refrigerated goods.

-

Benchmark for chemical products, machinery, textiles, and food.

Benchmark for chemical products, machinery, textiles, and food.

Airports:

-

Florianópolis (FLN) and Navegantes (NVT) with strategic international and domestic flights.

Florianópolis (FLN) and Navegantes (NVT) with strategic international and domestic flights.

-

Joinville and Chapecó complement the air network, connecting companies to national and international hubs.

Joinville and Chapecó complement the air network, connecting companies to national and international hubs.

Highways:

-

Strategic connections through BR-101 (north–south) and BR-470 (east–west),

allowing fast and efficient distribution of goods.

Strategic connections through BR-101 (north–south) and BR-470 (east–west),

allowing fast and efficient distribution of goods.

Business Environment

Santa Catarina stands out nationally for its competitive and simplified business environment:

-

Most competitive state in Brazil (CLP Ranking 2023).

Most competitive state in Brazil (CLP Ranking 2023).

-

Simplified bureaucracy for opening and operating companies.

Simplified bureaucracy for opening and operating companies.

-

Incentives for establishing operations in industrial and commercial zones.

Incentives for establishing operations in industrial and commercial zones.

-

Strong governmental support for foreign trade, with clear and secure policies.

Strong governmental support for foreign trade, with clear and secure policies.

Human Capital

The state offers skilled and diverse labor, ensuring operational excellence across different sectors:

Information Technology: hub in Florianópolis, known as the “Brazilian Silicon Valley”.

Metal-mechanical and textile industry: Joinville, Blumenau, and Brusque.

Highly skilled agro-industrial and export sector.

High-quality basic and university education, preparing professionals for complex operations.

Strategic Highlights

-

A state with a natural vocation for import and export, with consolidated experience in international trade.

-

Central geographic location in Mercosur, facilitating regional distribution and logistics.

-

High GDP per capita and political and economic stability, ensuring predictability for investments.

-

Infrastructure, tax incentives, and human capital converging to create the ideal environment for business expansion.

Foreign Trade Authorization – RADAR

We provide complete advisory services for obtaining, reviewing, or reactivating the RADAR authorization with the Federal Revenue Service — a fundamental process for enabling foreign trade operations. We offer technical guidance and follow all stages with agility and legal security.

Tax Advisory

Tax consulting applied to foreign trade, focused on legal cost savings and risk reduction, identifying benefits such as Ex-Tariff, Drawback, among others.

Technical and Legal Security

Complete technical and legal support in international operations, ensuring legal compliance, dispute prevention, and asset protection.

Your international operation

starts with SILCORTRADING!

Import, export, and distribute with security,

agility, and strategy.

Quotation and strategic contracting of international freight;

Quotation and strategic contracting of international freight; Commercial planning and international pricing strategy;

Commercial planning and international pricing strategy;

Development and qualification of suppliers and products;

Development and qualification of suppliers and products;